What is share market? How does it Work?

Share markets or a stock exchange are pretty much the most recent buzzwords. You might have come across this aspect quite a number of times, and if you are new to the stock market, this article can take you through the world of shares and stock.

stock market investment strategies

First, let us learn what it means. Share is the representative of a unit of ownership of the company from where you have bought it. For instance, let us say you have bought ten shares, each of ₹200, from the company ABC, and then you become a shareholder of the company ABC. It allows you to share the shares you bought at any time that you want to.

By buying a share, you are investing your money in the company that you buy it from. As the company grows or sees profit, your share will also simultaneously increase. You can get your profit from selling the stocks in the share market. Several factors can affect the price of your share. Sometimes, the prices can rise, and sometimes, the prices can even fall.

Do you wonder why a company sells its shares to investors or the public?

A company needs a certain amount of capital or money for its expansion, development, and much more. For this very reason, the company raises funds from investors, traders, and the public. The process by which the company issues shares to the niche is called the IPO [Initial Public Offer].

The Stock Market is Further Categorized in Two Categories:

The Primary Market

The Secondary Market

The Primary Market – It is a company or the government raising money from issuing shares in the primary market in the process of IPO. These issues can be done through public or private placements. The issue is public when the share allotment is above 200 people and private when the share allotment is less than 200 persons. The price of a share in the primary market can be based on fixed prices or book-building issues.

The Secondary Market – The shares that are bought in the primary market can be sold in the secondary market. The secondary market is a market that operates through an over-the-counter and exchange-traded market. These over-the-counter marketers are informal, where two parties agree to a particular transaction that can be settled in the future. These markets are highly regulated and are also called the auction market.

Why is this Market Critical to the Economy?

The stock exchange plays a crucial role in aiding the companies that seek funds and money for expansion and growth. Through IPOs, companies issue shares to potential share buyers and, in return, receive the funds they need, which can be used for various purposes. It, in turn, also increases the visibility of the company.

You can be a trader or an investor in this market. Traders are the ones who hold stocks for a short period, and Investors are the ones who invest their money in the stocks of the company for a more extended period. Traders can take advantage of the slight fluctuations and buy and sell stocks instantaneously, whereas investors stick with the company through its ups and downs.

What do you get by investing in these company shares?

By now, you know very well that you earn profit by investing in shares. Through the following ways, you will gain profits.

1. Dividends

2. Capital Growth

3. Buyback

If you are a newbie to the market, these terms might seem a little blue. So, let us dive deep into what they are.

Dividends:

Dividends are the profits a company earns, and this is distributed as cash among shareholders. These dividends are distributed according to the number of shares you own in the company.

Capital Growth:

The investment in equities or shares leads to capital appreciation. The longer the duration of the investment, the higher the returns will be. However, investments in stocks are also associated with risks. Your risk is based on your age, your dependents, and your needs. If you have a lower number of commitments, you can invest in equities in more significant amounts and simultaneously yield a lot more.

Buy Back:

A company buys back its share from the investors or shareholders by paying them a higher value than the current market value. It buys back shares when it has a huge cash pile up or in order to consolidate its ownership.

What is Supply and Demand in the Stock Market?

Supply and Demand in the Stock Market

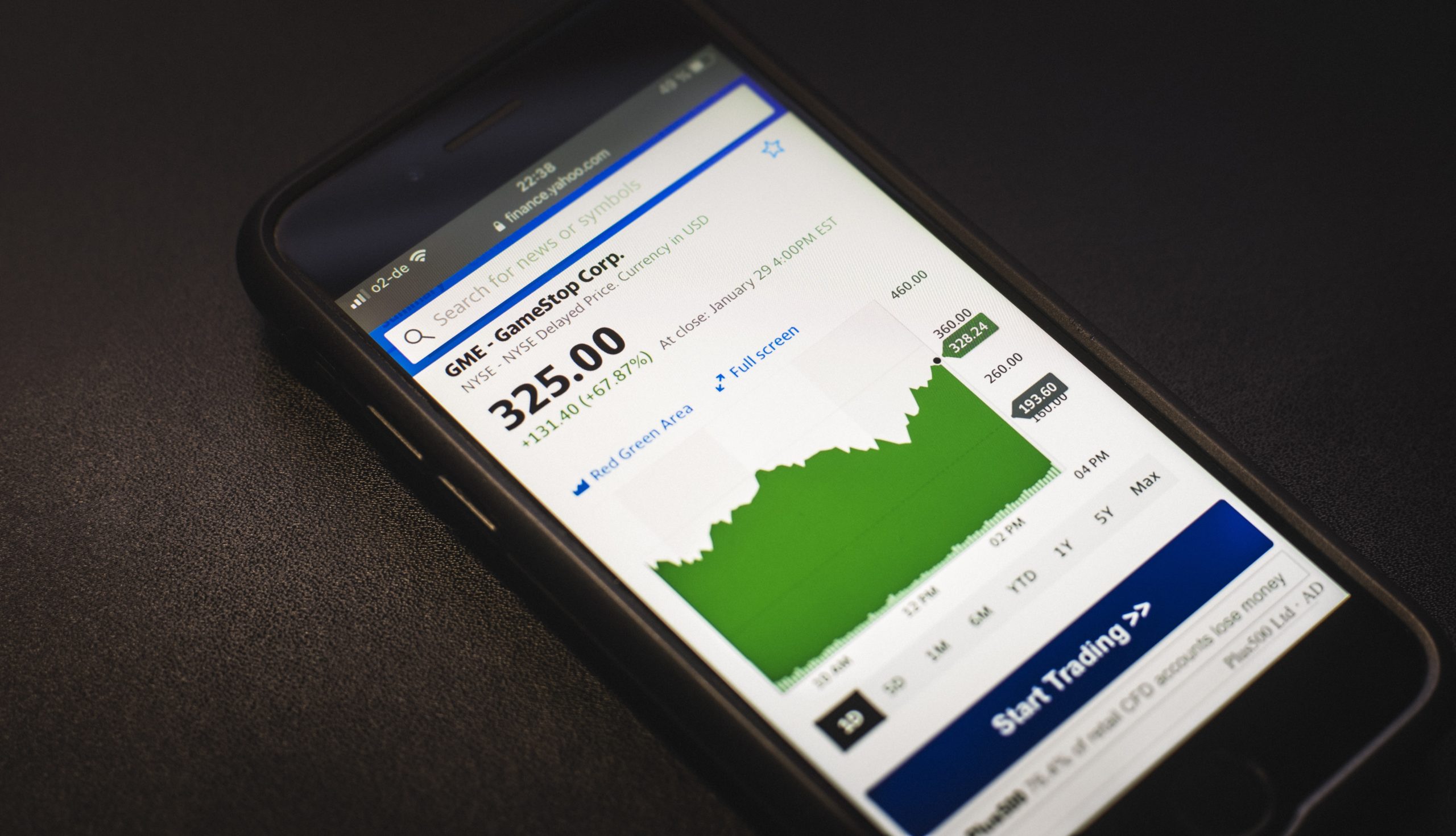

The stock market is also a fascinating example of supply and demand laws in action in real time. There must be a buyer and a seller in every stock transaction. If there are more buyers for a specific stock than there are sellers, the stock price will trend up due to the immutable laws of supply and demand. In contrast, if there are more sellers than buyers of stock, the price will fall.

So, what are the main elements you need to know about the stock market? Here are some foundation-building points that will give you a clear overview of it.

Key Takeaways:

Stocks or shares of a company represent the ownership equity in the firm, and it gives the shareholders voting rights as well as a residual claim on the corporate earnings in the form of capital gains and dividends.

The Share Market is where an individual or an institute of investors come together and buy and sell shares in a public venue. These days, the stock exchange also exists as an electronic marketplace.

The share prices are set by the supply and the demand of the market, as well as the buyers and sellers. Order flows, and bid asks are often spread by market experts/specialists or market makers who ensure orderly and fair markets.

Conclusion:

This article is the beginner’s guide to what a stock market is and who you can be in it. How is this such a significant part of the economy, and what can you take away from being a shareholder?