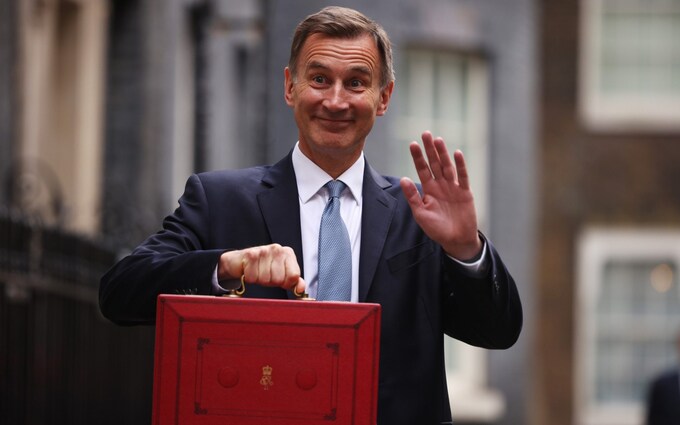

Jeremy Hunt’s Pension Reforms: What You Need to Know

Jeremy Hunt’s Pension Reforms

Chancellor Jeremy Hunt has unveiled sweeping reforms to the UK pensions market to give British workers a “pot for life” as part of his agenda to unlock retirement capital for savers. The reforms aim to merge workplace pension schemes and release up to £75bn of retirement funds for fast-growing startups, which could boost the UK economy.

Impact on UK Economy

The reforms could potentially unlock billions of pounds from pension funds for investment, which could be a significant boost to the British economy. The government believes that this could amount to £25bn by 2030, and the reforms could deliver an extra £1,000 a year in retirement income for today’s young savers.

The policy is aimed at encouraging British companies to invest more in the economy, and to help startups grow faster. By releasing retirement funds for investment, the reforms could help to create new jobs and stimulate economic growth.

Implications for Pensioners

The reforms are designed to give workers greater control over their retirement savings, and to provide them with a “pot for life”. This means that they will be able to take their pension savings with them when they move between jobs, and will have more flexibility in how they use their retirement funds.

However, there are risks associated with the reforms, particularly for defined benefit pension schemes. These schemes guarantee a certain level of income in retirement, but they are expensive to run and can be vulnerable to changes in interest rates and inflation. The reforms could lead to more companies closing their defined benefit schemes, which could leave some British pensioners worse off.

In conclusion, Jeremy Hunt’s pension reforms could have a significant impact on the UK economy and on the pensions industry. While they aim to provide workers with greater control over their retirement savings, there are risks associated with the reforms that need to be carefully managed.

Investment Opportunities and Risks

Role of AI and Fintech

The pension reforms proposed by Chancellor Jeremy Hunt are expected to unlock up to £75bn in pension savings to invest in the UK’s economy. With the help of AI and Fintech, this capital can be invested in infrastructure, corporate bonds, and private equity, among other opportunities. The use of AI and Fintech can help fund managers and investors make more informed decisions, reduce risk, and improve returns.

However, it is important to note that AI and Fintech also come with their own set of risks. The use of algorithms to make investment decisions can lead to unintended consequences, and the lack of human oversight can result in errors. Additionally, the use of AI and Fintech in the pension industry is still in its early stages, and there may be regulatory and legal issues that need to be addressed.

Private Equity and Start-ups

The proposed pension reforms are expected to help boost growth in the UK’s start-up and private equity industries. By merging workplace pension schemes and releasing retirement funds, start-ups and private companies will have access to more capital to help fund their growth. This is expected to attract more business to the UK and help create jobs.

However, investing in private equity and start-ups also comes with risks. These investments are often illiquid, meaning they cannot be easily sold or converted to cash. This can lead to a lack of diversity in the investment portfolio and a higher risk of losses. Additionally, the Pensions Regulator has raised concerns about the risks associated with investing in illiquid assets, and has called for greater transparency and digital access for policyholders.

Overall, while the pension reforms proposed by Chancellor Jeremy Hunt offer investment opportunities, they also come with risks that must be carefully considered by trustees and fund managers. By balancing the risks and opportunities, the pension industry can help support the UK’s economy and provide better returns for customers.