If you spend enough time around public companies with big crypto treasuries, you start to recognize the tells. A few weeks of choppy trading. A sharper‑than‑usual gap lower on a sleepy Monday. Then the quiet press release: the board has authorized a share repurchase program. No fireworks, just a lever pulled with a certain steeliness. It’s an old market reflex meeting a new kind of balance sheet—Bitcoin on one side, sticky operating costs on the other, and a stock chart that now behaves like a proxy for digital risk.

Why buybacks, and why now

For treasury‑heavy firms—miners, exchanges, custody providers, fintech platforms with tokens on the balance sheet—the equity price often moves in lockstep with crypto cycles. When those holdings weaken, the discount between intrinsic value and public valuation can widen into something ugly, even irrational. A buyback is a blunt instrument, but it’s effective. Retire shares at a depressed price, improve per‑share metrics, and signal confidence without promising what no one can guarantee: where Bitcoin, Ether, or the broader tape will trade next week.

There’s another layer. Many of these companies raised capital in the last two years on the back of “digital asset optionality.” As those bets get marked‑to‑market, boards look for tools that don’t dilute existing holders or trigger covenants. Debt can be expensive, dividends feel tone‑deaf amid volatility, and tender offers are slow. Repurchases thread the needle—discretionary, scalable, and fast.

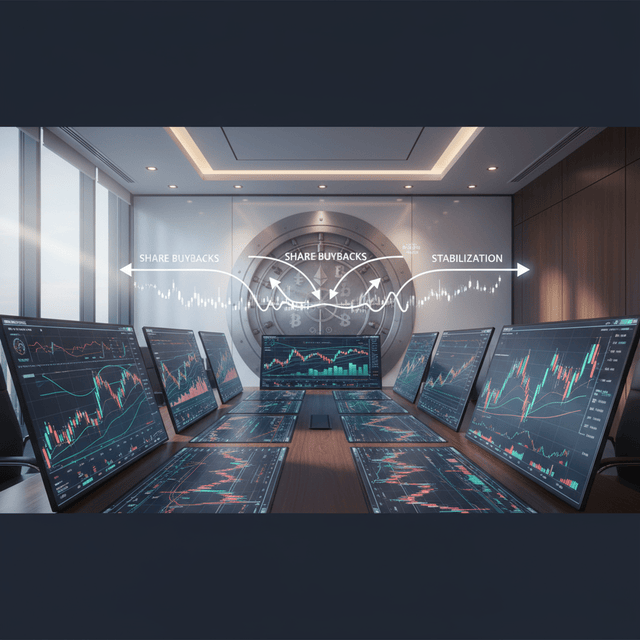

The mechanics under the hood

On the desk, it looks like this: a 10b5‑1 plan preloaded with guardrails, a broker executing in small clips to avoid spooking the order book, and strict blackout windows around earnings and material announcements. Some firms pair buybacks with concurrent asset sales—lightening crypto exposure on green days to refill cash while using red days to soak up equity. Others lean on operating cash flow and short‑term facilities, betting that stabilizing a wobbly chart is cheaper than letting equity cost of capital climb.

For companies whose brand equity is tethered to “diamond hands,” there’s a delicate choreography. You don’t want to look like you’re dumping coins to prop the stock. The savvier CFOs communicate a treasury framework: base reserves ring‑fenced for operations; opportunistic trimming at predefined levels; and a standing authorization to repurchase when the equity trades at a material discount to a blended NAV and cash‑flow outlook.

What the signals actually say

- Confidence, not clairvoyance: A buyback doesn’t call a bottom in Bitcoin. It says, “We can control our share count and runway better than the market is pricing.”

- A floor, not a trampoline: Repurchases can smooth jagged edges, but they rarely reverse a secular drawdown on their own. When the crypto cycle turns, they amplify the recovery by compressing float.

- Discipline over drama: The credible programs are measured—dollar‑cost‑averaged over quarters, not sprayed in a week for headlines. Boards that track return on buyback (yes, it’s a thing) tend to keep using the tool wisely.

The risks no one should hand‑wave

Buybacks burn dry powder. If the macro picture sours or a crypto drawdown runs longer than models anticipated, yesterday’s repurchases can crimp tomorrow’s flexibility. There’s also the optics: in an industry still fighting for mainstream trust, aggressive buybacks can look self‑serving if headcount is shrinking or capex is deferred. And for firms with token exposure plus equity exposure, correlation risk cuts both ways; getting the timing wrong can compound pain.

Governance matters here. Clear caps, transparent criteria, and board‑level reporting keep repurchases from sliding into reflex. The best programs read less like a hunch and more like a capital allocation policy: thresholds, triggers, and the humility to pause when conditions change.

How this feels on the ground

You notice the difference in the tape first. Spreads tighten at the close. The usual air pockets around midday don’t open up. Liquidity appears where it used to vanish—someone is patiently buying the dip, five hundred shares at a time. Inside the building, the CFO’s war room is all dashboards and deadlines: utilization of the plan this week, average price achieved, remaining authorization, cash and crypto runway at various vol shocks. It’s not glamorous. It’s quiet, methodical ballast.

What to watch next

- Pairing with hedges: Expect more firms to offset treasury volatility with options—collars on BTC/ETH—to free up confidence for equity repurchases without overexposing the cash stack.

- Smarter disclosures: Quarterly letters that tie buyback cadence to a NAV band or cash‑flow corridors will separate disciplined allocators from headline hunters.

- New baselines: If crypto winters stay shorter and shallower, repurchases could evolve from “stabilization” to a standing feature of capital return—especially for companies with maturing, non‑cyclical revenue lines alongside digital assets.

In a market that still swings between euphoria and existential dread, buybacks are the corporate equivalent of deep breathing. Slow the pulse. Tighten the float. Remind long‑term holders that someone with a calculator, not a meme, is minding the store. It won’t make red days fun. But it turns chaos into arithmetic—and, for public companies straddling the crypto frontier, that’s often the difference between enduring the cycle and being defined by it.