Guide for Freelancer’s to Get Paid Online in 2022

Invoicing is one of the most critical tasks for independent contractors to manage. What’s the use of providing services if you don’t bill your clients? Unfortunately, the majority of independent contractors say they have difficulty getting compensated for their work. Because we’ve been there ourselves, we’ve put together this guide to online payment. Hopefully, you’ll never have to worry about getting paid online once more after reading this guide.

- Make the Effort to Understand Your Customers

Turning down a potential customer as a freelancer seems counterintuitive. Before taking a new job from a customer you’ve never worked with, you should do some investigation. Why? So since this client may be known for skimping upon payments to former employees of this firm. If you do a simple online search, you may be able to determine whether or not this client is genuine. If so, where can We find them online? Look out their site, Facebook, Twitter, and LinkedIn profiles if they have one to see if they’re well-known in the community.

- The Client Must Agree to a Set of Clear Rules.

Before beginning a new project, every freelancer should have a set of guidelines in place. Your payment conditions should be the primary focus of these guidelines. This specifies when and how you expect to get compensated for your services. An illustration would be an invoice sent via PayPal, with an expected pay-out date of 30 days later. The scope of the task, deadlines, ownership of a work, disclaimers and caveats, and cancellation clauses should also be included in the contract. When bargaining with a client, it’s fine to bend the rules a bit. Do not shift your position too much. While you and the customer have agreed to these terms, make sure you have a signed contract. As a result, both sides will be able to fulfil their promises.

- Obtain a Deposit

If you’re a seasoned freelancer, you’ll know that getting a deposit from a new customer is always a good idea. Your expenses will be covered while working on the project, and in the event that the client fails to pay up, you will not be financially ruined. Moreover, it’s the norm in the sector. So, don’t be shy about requesting a down payment. Negotiate the amount you ask for. It’s not uncommon for contractors to request a down payment of 50%, a mid-project payment of 25%, and a final payment of 25%. Invoice for at least one to two weeks’ worth of time if you’re invoicing per the hour.

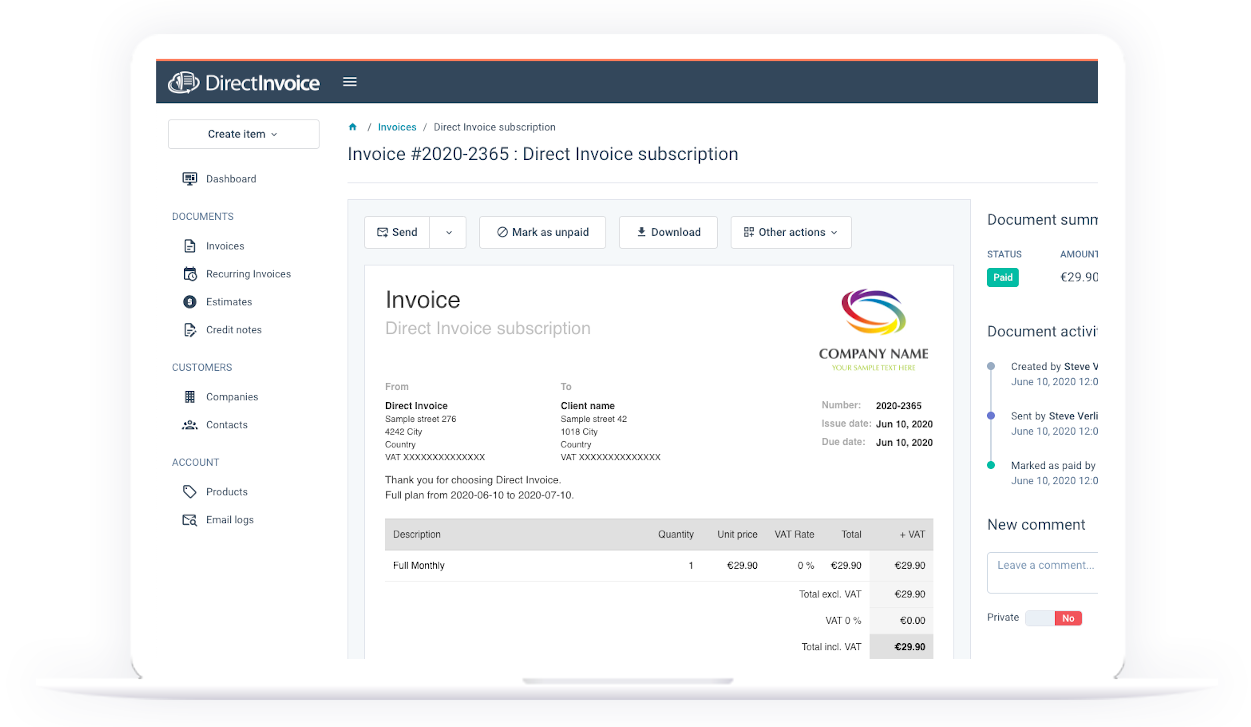

- Create an Invoice

Until virtualized invoicing applications like Due came out, freelancers will have to make invoices by hand with programmes like Pages and Numbers. They would also have to use programmes like Word, Excel, as well as Google Docs. Fortunately, this is no longer the case. N Automated follow-up and recurring payments are all possible with maki invoice template pdf using invoicing software. You can quickly and easily prepare and share invoices electronically using pre-built templates. But the core elements of an invoice have not changed, even though billing software can save independent contractors a lot of time and money. Among them are:

- The logo of your company.

- Invoice number, like Invoice: 00001.

- This is the date by which you should expect to receive your payment.

- Details of how to reach you and your client, respectively.

- A detailed description of the services and tasks to be performed.

- Taxes that are owed.

- The whole sum that must be paid.

A 2 percent discount on the invoice amount if the payment is made online within 10 days, or a 2 percent monthly interest penalty once the due period has passed. Options for making payments include PayPal, credit card, and eCheck. There is no need to issue an invoice for each billing cycle if you have regular customers. Instead, you can automate the charging of a customer’s credit card or bank using a recurring payment option. If you don’t have a steady stream of customers, make sure to invoice them on a regular basis and promptly. Once a week or just after completing a task, it will keep the money coming into your bank account. Additionally, it helps to make sure that you don’t neglect to bill the customer. The longer you delay to invoice your customers, the less probable they are to pay your invoice.

Conclusion

Creating an invoice by hand and mailing it is a thing of the past, thanks to automation. Using electronic invoicing, you can now get paid the same day. However, despite the fact that this makes your freelancing life a little easier, you still need to do your due diligence before beginning a project with a customer.