When searching for a mortgage, it’s essential to compare lender costs such as interest rates and closing fees. Furthermore, it’s advisable to shop lenders within a 45-day window so multiple credit inquiries do not negatively affect your score too significantly.

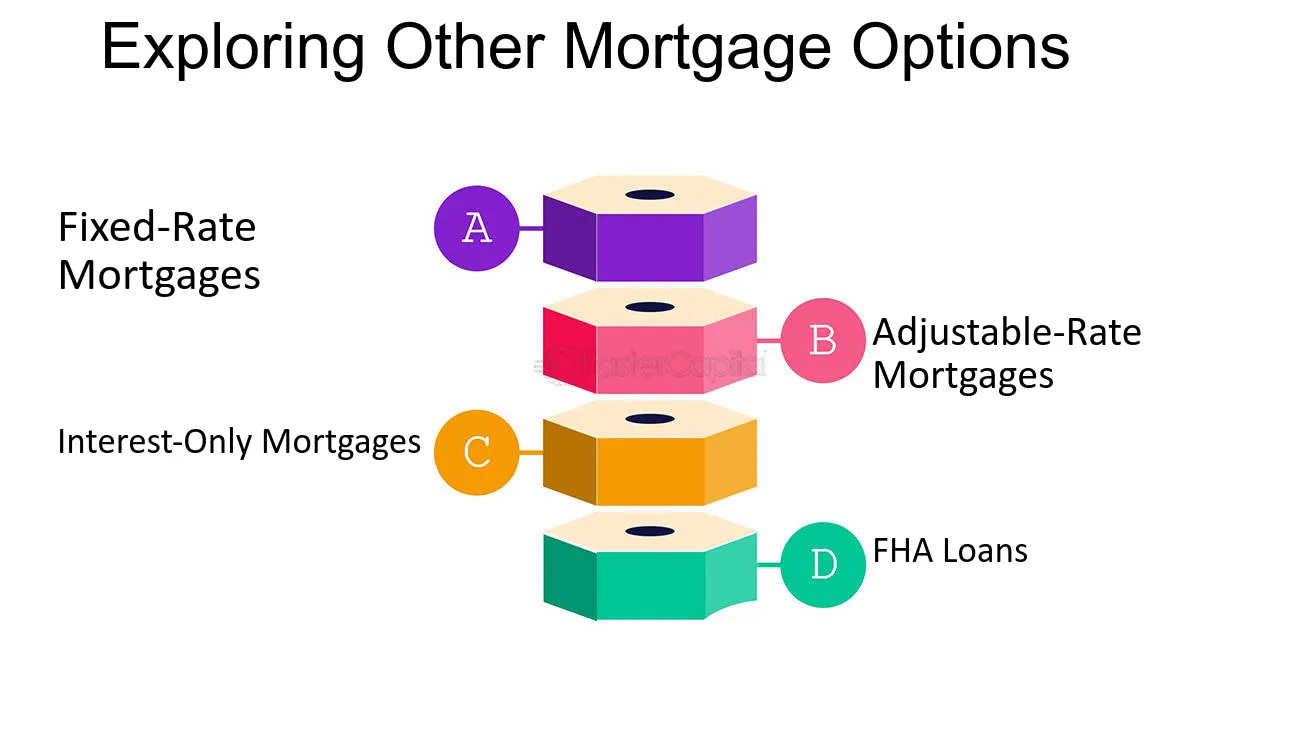

Home buyers typically opt for a 30-year conventional fixed-rate mortgage; however, it’s essential that they understand all their mortgage options that may better suit their unique situation. Mortgage options for those who live in Hamilton can be researched online.

It is always up to a bank to either finally approve or deny your mortgage loan based on the lender’s requirement and it is also always best to seek professional advice when considering any mortgage decision.

1. Insured Mortgages

One of the more complex mortgage terms to learn is insurance. This could refer to either mortgage life or loan insurance policies – protecting both you and the lender in case of default on your mortgage loan agreement.

In Canada, mortgage insurance is provided by three private insurers – Canada Mortgage and Housing Corporation (CMHC), Canada Guaranty and Genworth – offering insured mortgages that allow consumers to become homeowners with minimal down payments of only 5% while offering competitive interest rates over conventional loans.

Some borrowers elect to combine an insured mortgage with an unsecured second loan known as a piggyback, often advertised as cheaper for them. But before making this choice, always compare costs before making your final decision – piggyback mortgages often carry higher interest rates as well. You must also meet GDS/TDS ratio requirements set by lenders when making this choice, which measure how much monthly income corresponds with home ownership costs and any debt payments due.

2. Uninsured Mortgages

Uninsured mortgages, also known as uninsured loans, do not come with mortgage insurance coverage and are therefore only suitable for homebuyers with at least 20% down payments and an interest rate above 6.99% due to increased risk taken on by lenders when lending without mortgage insurance in place.

Mortgage default insurance is always required on high-ratio mortgages, while it may also be necessary for insurable mortgages with down payments under 20%. The lender takes on more risk by accepting less deposit money upfront from borrowers; as a result, mortgage default insurance protects lenders in case any defaulted borrowers default and they incur financial loss as a result of nonpayment of mortgage debts.

Saving for a substantial down payment can be challenging for many Canadians, which is why insured mortgages are such a valuable tool in helping people to achieve their homeownership dreams. They feature lower down payment requirements than uninsured loans as well as lower interest rates – making them the optimal solution for most.

3. Mortgage Renewals

Mortgage renewal time provides an ideal opportunity to compare lenders and brokers. Most financial institutions will begin the renewal process around 120 days (or approximately four months) prior to your mortgage term ending, giving borrowers time to renew with their current lender, switch providers or qualify for new mortgage without incurring prepayment penalties.

Mortgage renewal time offers you the perfect opportunity to reassess your financial goals, current situation and plans for the future. Perhaps it is time to change length of term or access some equity by refinancing. Although no reset button exists for our lives today, mortgage renewal provides an ideal chance to renegotiate with your lender in order to find an optimal compromise – keep a great rate while adapting terms to fit with your plan!

4. Refinancing

Refinancing occurs when a borrower replaces their mortgage loan with another one. Refinancing may be undertaken to lower interest rates and therefore lower monthly mortgage payments; alternatively it may change terms, for example switching from 30-year to 15-year loans in order to pay off debt faster.

Before refinancing, it is advisable to shop around to compare mortgage rates and terms that meet your needs and evaluate whether you will save enough on interest costs with your new loan to make the effort worth your while.

Borrowers must provide banks with all required documentation, such as recent pay stubs, federal tax returns and credit history reports as well as an appraisal of their property and net worth assessment. Being prepared will make the process go more quickly and smoothly resulting in faster and smoother experiences overall.